In case you have not heard, YouTrip is a debit card which allows you to spend in foreign currencies at no additional fee. In simple words, it means we can spend overseas at a lower exchange rate! So, with such high expectations for the YouTrip card, we brought it along for our Taiwan and USA trips – and it was a love-hate relationship. Here’s our honest YouTrip review!

We loved it because..

#1. The exchange rate is really nubbad!

Being a kiasu Singaporean, I still changed a bit of TWD and USD in cash because not everywhere accept cards right? Plus, what if the exchange rate at Raffles Place is better? Surprise surprise, after comparing the exchange rate, YouTrip actually gave a comparable exchange rate! Here’s the exchange rate for comparison:

TWD

– Youtrip: 1 SGD to 22.33 TWD

– Money changer: 1 SGD to 22.37 TWD (rates taken from https://cashchanger.co/)

USD

– Youtrip: 1 SGD to 0.734 USD

– Money changer: 1 SGD to 0.734 USD (rates taken from https://cashchanger.co/)

We all know that if the exchange rate is comparable to money changer – then it’s definitely WAY better than charging it to your normal credit card.

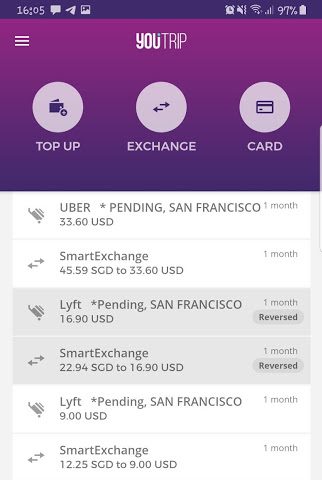

#2. View your transactions in real time

As compared to conventional credit card, where it will take at least a few days for the transaction to show on your statement, YouTrip shows it almost immediately. So, you can see the exchange rate immediately and feel good about the money you’ve saved. 🙂

#3. Withdraw cash at only a SGD 5 flat fee

So, I enjoyed myself so much in Taiwan that I finished my cash. I panicked a little before I realised that I can actually withdraw cash from my YouTrip card at any Mastercard ATM with just a $5 flat fee, anywhere! This is so much more lower than the fee I was charged when I withdrew Thai Baht in Bangkok. Just as a gauge, banks usually charge a withdrawal fee (min $5) plus processing/administration fee which is usually a percentage of your amount.

#4. Top up anytime and anywhere!

Ran out of money in your YouTrip card? You can easily top up anywhere with just one or two clicks, as long as there’s internet connection. I remember getting carried away in the Las Vegas premium outlets and it took me less than 30 seconds to load the app and complete my top up. Almost too easy for shopaholics actually 😡

….

But the YouTrip card is not perfect..

#A. Not the best card for hotels or car rental companies to hold for deposits

Afterall, YouTrip is more like a debit / pre-paid card which means you can only spend whatever you have in the balance. So, when you use it at hotels or car rental companies for deposits, it means $x will be frozen UNTIL they release it. Depending on the hotel or car rental company, it may take days to weeks for the amount to be released back to your card. Imagine having a thousand bucks stuck on the card! So, we’ll highly recommend that you use your credit card for such deposits.

#B. You need internet connection for top-ups

So, when it comes to places with weak internet or 3G/4G signals, you will be left with no choice but to use your credit card. Almost happened to me so make sure you have enough balance before you join the queue!

#C. It becomes guilt-free to shop, oops!

Actually, this could be under why we love this card too (depends on perspective right?). But when you know you are not incurring additional fees just for shopping overseas, you feel like everything is a good deal. Oh well, perspective.

If you travel a lot (and shop a lot on foreign currencies), I would say the YouTrip card is a MUST have. (unless you are trying to accumulate miles) For those who are in my ‘Cash is King’ camp, just sign up for your YouTrip card already!